Introduction to VAT in UAE

Value Added Tax (VAT) was implemented on 1st of January, 2018 in UAE at a rate of 5% for every mainland transaction. The Value added Tax was imposed to help UAE government move towards its vision of reducing dependence on oil and other hydrocarbons as a source of revenue.

The transactions between a selected group of free zones remains free from paying VAT. All the other business transactions will be liable to pay 5% VAT for the Federal Tax Authority. (FTA)

Only VAT registered businesses are authorized to collect 5% tax from the transaction amount on behalf of the government from the customers. This collection of payment will be paid to the Federal Tax Authority through the online portal every three months. (VAT Filing)

At the same time, VAT registered businesses receives a refund from the government on the tax that it has paid to its suppliers.

Criteria for registering for VAT

Option 1– A business must register (Mandatory) for VAT if its taxable supplies and imports exceed AED 375,000 per annum.

Option 2– It is optional for businesses whose supplies and imports exceed AED 187,500 per annum.

How to register for VAT?

Businesses should register for VAT through the Federal Tax Authority (FTA) website. First the applicant should create an account. You may have to provide relevant document for the registration.

There are mainly two process involved in the VAT Registration.

- Create the E-Service Account

- VAT Registration Process

1. Create the E-Service Account

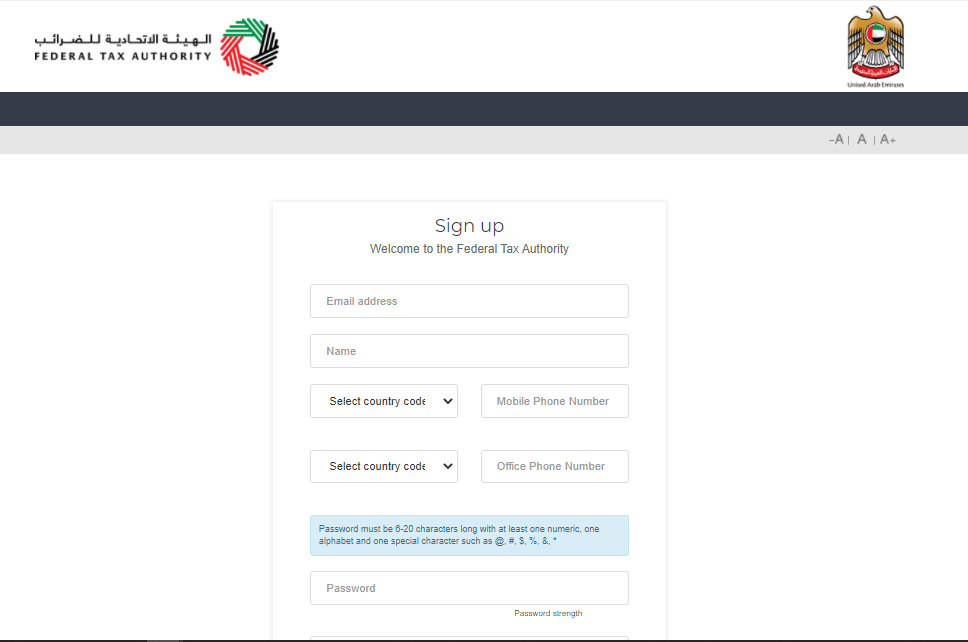

First the applicant should create an e-service account through the Federal Tax Authority website. This is quite similar to creating an online account on Yahoo, Gmail etc.

- Visit ‘https://eservices.tax.gov.ae‘ and click signup and enter the details such as functioning E-mail ID, Password, security code and security question (Please remember the security question for later use).

- Verify the E-mail- You will receive an E-mail for your registered E-mail.

- Log in to the account with the Username and Password.

2. VAT Registration process

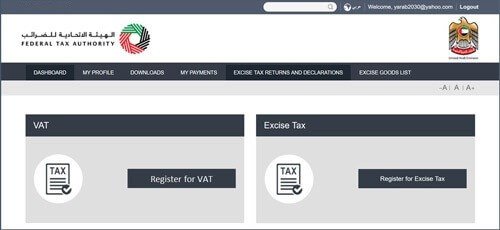

First the applicant should login to the e-Service account using the login credentials. Soon after you log into your account you will see an option called ‘Register for VAT’.

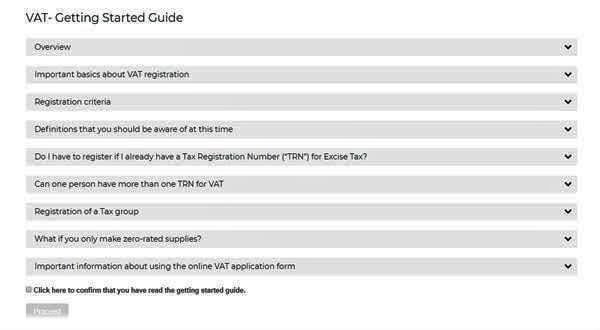

VAT- Getting Started Guide

Click on ‘register for VAT’ and you will be directed to ‘Getting Started Guide’. Each section of the guide contains the information required for successfully completing the VAT Registration. Please carefully read the guide and please tick the box with ‘Click here to confirm that you have read the getting started guide’ and click ‘Proceed’.

VAT Registration Form

Once the applicant clicks on ‘Proceed’ he/she will be directed to the VAT Registration Form.

The form will contain 8 sections and each section should be filled by the applicant to successfully register for the VAT. Different colour indicators will show the progress of the VAT Registration. The section that are completed will be indicated by a green tick and the updating section will appear in brown. Fill in all the sections with relevant information, the portal will only allow you to move to next sections if the details are captured in all the mandatory fields which are denoted by a red asterisk (*). For any further clarification do not hesitate contact our Eagle Eye Team our team will assist you in completing the process.

Review and Submit

Fill in all the required details in each section and at last on the 8th section you should verify the provided details and submit for the Federal Tax Authority Approval.

Upon successfully completion appliocant should receive your VAT Certificate with TRN Number within one month from the date of submission.